Table of Content

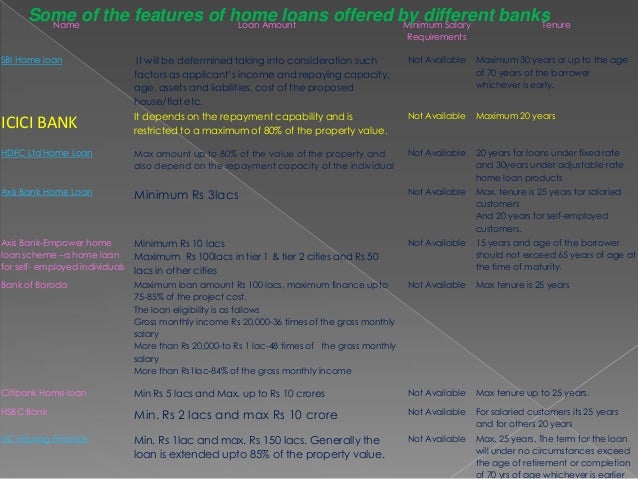

Whether your goal is to purchase or build a new house, we offer a wide range of products to meet your requirements. We offer affordable Home Loans at attractive interest rates for a tenure of up to 30 years. “Simply put, my wife and I would not have our dream home without the help of LoanLink and Başar. Although our personal/financial situation was less than ideal, Başar was able to secure us an extremely favourable loan. We compare the best mortgage rates in Germany for the top 750 lenders. One of the key competitive advantages of ICICI Bank Home Loans is our large database of approved projects.

There are/shall be no legal or regulatory prohibitions or impediments, as per the laws of my/our home country, against my/our maintaining my/our relationship with ICICI Bank, including availing the aforementioned Facility. I/We hereby certify that I am/we are resident outside India who is/are either citizen of India or Person of Indian Origin (“Non-Resident Indian”) as defined under the Foreign Exchange Management Act, 1999 as amended, modified or updated from time to time. I also authorize ICICI Bank and its representatives to call/e-Mail/SMS/WhatsApp me regarding Home loan application. You can prepay part of the loan at no cost during the tenure of the loan. Variety of products are available depending on your unique needs such as buying a house, building a house, purchasing property in India, etc.

Steps to get Insta Home Loan Balance Transfer

ICICI Bank’s floating rate of interest is linked to Repo Rate declared by RBI from time to time. So, rate of interest of your housing loan changes in line with the Repo Rate. As a result, the EMI or the tenure of your loan will increase or decrease, depending on the change in the rate of interest. To apply for a home loan, you need to submit documents such as a proof of identity, a proof of address, a loan application form that has been duly filled and your financial documents. This goes on until at the end of the loan, the principal repayments are almost 100% of the monthly annuity.

Yes, you can claim the amount paid towards the repayment of the principal and the interest components as deductions in your income tax return. The limits on the amount deductible are governed by the applicable income tax laws. As per guidelines of RBI, floating rate Home Loans from banks are linked to external benchmark rates.

What is an EMI?

Hypofriend works together with over 750 partner banks to find customers the optimal mortgage. Your personal mortgage expert will support you to review and understand all your options. We'll calculate your maximum property budget based on your income, savings, residency status and the criteria of our 750+ partner banks. Combining this lender know-how with given information and projected information , we evaluate a range of scenarios and outcomes to see how you will fare under different conditions. We discuss the outcomes and logic of the recommendations with you.

The conversation with you and the branch manager followed by the experience has reposed out faith in ICICI Bank as a result we would be moving more family accounts to the ICICI Bank Branch. Once you've selected your mortgage offer, we will provide you a document checklist that shows all the required document you need to submit. Our advanced technology compares mortgage options from over 400 German lender and our mortgage experts will explain each offer. Getting a German mortgage pre-approval will help you stand out from other potential homebuyers. Banks in Germany like safety and are interested in you paying back the mortgage. That is why banks in Germany are so strict about approving a mortgage.

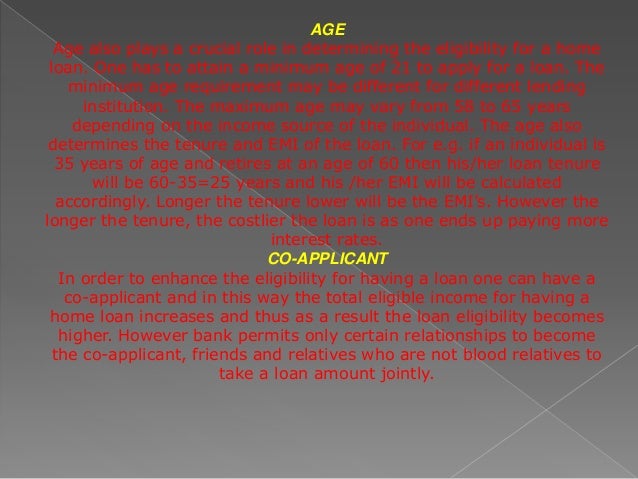

Who is a co-applicant? Is a co-applicant mandatory for a loan?

"Our account manager really helped us through every step of the process and was always available for questions or to answer concerns. We really could not have done it without them and i would absolutely recommend to use this provider." J. From the first touchpoint, they guided us through step by step and answered our overwhelming amounts of questions. Home Loan eligibility is calculated after considering various factors including monthly income, fixed monthly obligation, current age, retirement age etc. Your home loan eligibility can also be considered an indicator of your home loan affordability. To optimize the recommendation engine, we review daily the mortgage products and conditions of over 750 lenders.

I/we understand that the processing fee is a one-time non-refundable fee and is collected by ICICI Bank for the purpose of processing my/our loan facility request and such processing fee once paid, will not be refunded in any circumstances. This annuity payment consists of both interest and principal repayment. The composition of interest and repayment changes slightly with each month.

Interest Rate

To find the right mortgage, there are some points you should consider. For example, it is advisable to plan the mortgage, so you have paid it off by the time you retire. Also, keep in mind that you usually need to pay the additional purchase costs yourself. However, it is possible to take out a separate personal loan for this purpose. Furthermore, your monthly repayment should be calculated realistically, so you can easily cover it without having to restrict your accustomed standard of living. Repayment period Regardless of the interest rate, the faster you repay your mortgage, the lower your financing costs will be, as you will only pay interest on the remaining loan amount.

I/We shall not hold ICICI Bank liable or responsible in any manner whatsoever or make any claim against ICICI Bank or the regulators in Oman, Qatar, QFC, Singapore, UAE, DIFC, Bahrain or India in relation to the management or operations of the Facility. I/We agree to receive update on various products and services related information and special offer from ICICI Bank/group companies and other entities via email alerts, or SMS alerts or phone call. /We hereby declare that the information of GSTIN with respect to the number and billing address is correct and ICICI Bank can update the same in its records. I/We hereby declare that the information provided can be used by ICICI Bank for the purposes of charging GST and reporting of transactions on the GSTN portal and for other related aspects in relation to reporting as stated under GST Act and applicable rules in this regard. I/We acknowledge that ICICI Bank reserves the right to retain such documents submitted with this application and will not return the same to the me/us.

The hike in rates will be applicable for both new as well as old customers. After the hike a new home loan borrower from HDFC with a credit score of 800 and above will pay 8.65%. Borrowers below this credit score will pay 8.95% to 9.30% interest rate depending on their credit score, financial situation and whether they are salaried and self employed. In your secure online account, you can easily upload your required personal, property and mortgage documents to get approved faster than traditional brokers.

Vice versa, the slower you repay your loan, the higher your financing costs will be. How fast you repay your mortgage loan depends on the amount of your monthly rate and additional repayments you may make. In Germany, most banks offer the option of additional repayments between 5% and a maximum of 10% per year.

However, too long a fixation period could result in high costs, inflexibility, or exorbitant cancellation fees if you move on early. Hypofriend’s Optimization Engine will recommend the optimal fixed interest period for your situation. Mortgage lendersto reduce time and optimise the mortgage loan experience. Once the mortgage lender has received the required payment order documents, they will pay out the loan. Like many mortgage brokers, we get paid by the German lender banks.

Please note Co-applicant’s income can be considered for enhancing loan eligibility. I would like to thank you from the bottom of my heart for the timely approval and disbursal of my Home loan. I would like to highlight that the loan request I placed was addressed well within time and you have been constantly in touch with me to ensure that the home registration date must be adhered to. I would gladly recommend and endorse your and ICICI Bank Home Loan service to all my friends and acquaintances who may be in need of them.

German Mortgage Calculator

The area of an apartment or building, not inclusive of the area of the walls is known as carpet area. This is the area that is actually used and in which a carpet can be laid. When the area of the walls including the balcony is calculated along with the carpet area, it is known as built-up area.

By continuing to use the site, you are accepting the bank's privacy policy. A fixed rate of interest on a home loan means that the rate of interest does not change throughout the tenure of the loan. A home loan is essentially a financing option where funds are provided to an individual or an entity for the purchase, construction, extension, or renovation of a residential property. Explore a vast database of 40K+ ICICI Bank approved projects by leading developers, across 44 locations in India. The mortgage approval is a binding document which certifies that your lender will support you with the funding. Our custom optimization engine and expert advisors will help you make the optimal decision for your personal circumstances.